Fabrick Smart Banking

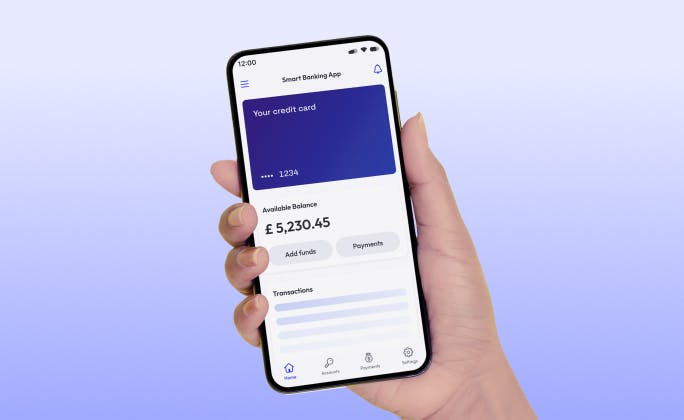

The solution enables banks and enterprises to create an application linked to a card payment account to provide end customers with access to financial payment and rewards services.

The ready-to-use and modular mobile banking application

The synergy between Fabrick and specialised partners allows the development of a Smart Banking app that can be integrated with digital payment services:

Banking and payment services in one touchpoint

All available features:¹

- Payment account

- Creation of cards that can be tokenized and associated with Apple Pay and Google Pay wallets

- Compatibility with iOS and Android devices

- Digital payments to private individuals (P2P) and shops (P2B)

- PFM, piggy bank and projects, address book function

- Credit transfers, pre-marked bills and phone top-ups

- Rewards functionality for loyalty plans

Banking and payment services in one touchpoint

All available features:¹

- Payment account

- Creation of cards that can be tokenized and associated with Apple Pay and Google Pay wallets

- Compatibility with iOS and Android devices

- Digital payments to private individuals (P2P) and shops (P2B)

- PFM, piggy bank and projects, address book function

- Credit transfers, pre-marked bills and phone top-ups

- Rewards functionality for loyalty plans

Added value for banks and companies

Fabrick Smart Banking enables the creation of an innovative and customised mobile banking app that responds to many use cases:

An app to make banking and payment services fully digital.

A tool that allows customers to make simple and immediate payments on a private circuit.

New ways to redeem amounts via transfers or payments, and to define savings plans and piggy banks.

Simple and intuitive mobile banking functions for banks and businesses targeting young people.

A rewards platform to offer customers loyalty plans such as member-get-member and cashback.

Innovative integrations for an enhanced Smart Banking experience

It aggregates all the user's accounts in the app, even if they are opened in different banking institutions, to provide a complete view of financial flows.

It integrates the Account to Account (A2A) payment method, which allows the user to make pre-filled transfers.

It enriches the product with loyalty and cashback features that create added value to the user experience.

² AIS and PIS solutions are not available in the UK. Fabrick provides these solutions only in Italy, Spain and France. If your business has a registered office in Italy, Spain or France and you would like more information, you can contact us here.

Our insights

Integrating PISP services into the ERP system: invoice and payment reconciliation on a single platform

Why Open Finance and Embedded Finance are transforming the Energy & Utilities sector in the UK

Open Banking in 2026: Trends and What to Expect

Would you like more details about this product? Please fill out the form.

Contact our specialists to identify the most suitable solution for your needs.

¹ Some of the functions included in the product (e.g. account subscription/card issuing/payment services) are only available after integration with authorised financial partners.