How Artificial Intelligence is improving the payment industry

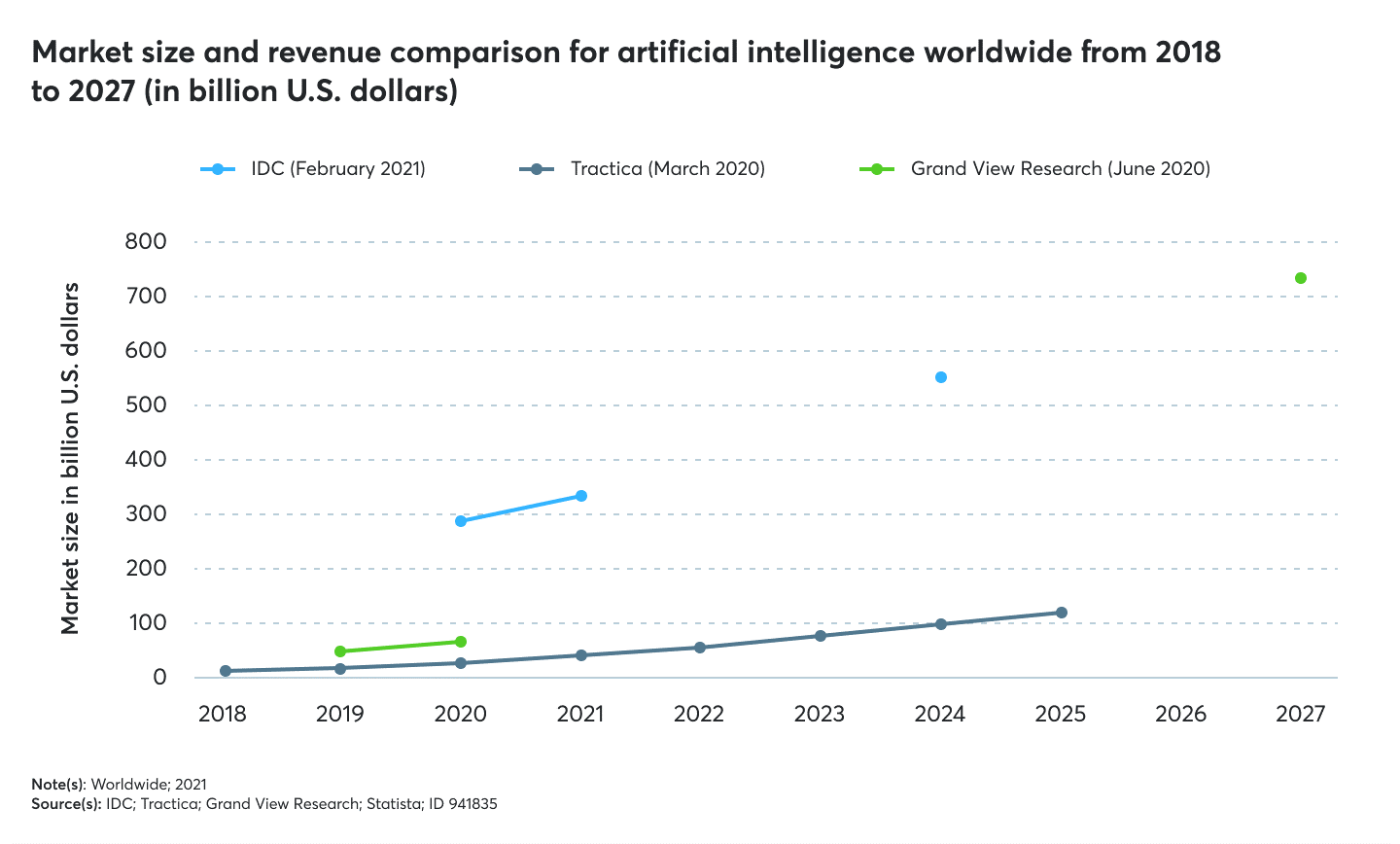

When looking at the world of artificial intelligence and how it’s shaping the payments landscape there is an increasing number of different applications that are developing at a fast speed across different industries. The growth of the global AI market was projected by the market research firm IDC to reach a size of over half a trillion U.S. dollars by 2024.¹

As it is in many other sectors, the payment industry is very prone to benefit from the algorithms of AI and what it can bring to the table in terms of increased performance, customer experience and personalisation. What are the main areas of application for AI in payments and how fast has this market been growing? Let’s start from the beginning.

What is artificial intelligence?

Firstly, we need to define what artificial intelligence actually is. Originated in the computer sciences, AI has quickly developed in many sectors and has now become part of our day-to-day life, with use cases like voice assistance in mobile phones, digital assistants, robots for the house and many more. It refers to the capability of a machine to perform tasks by replicating human intelligence, such as decision-making, visual perception, speech recognition.

When we look at the Ecommerce world, this technology is being implemented and seen as a way to add customisation for their customers. Looking only at the turnover of the chatbot market, one of the countless applications of AI for the Ecommerce sector, the volumes are set to grow considerably: by 2024, the market is expected to be worth USD 180 million and will increase to over USD 450 million by 2027.²

Although there are many areas of Ecommerce where artificial intelligence can be applied to improve customer’s shopping experience, in this article we are going to focus on the checkout phase and payment processing and how AI can help seal the deal with customers.

AI in payment processing

The payment’s landscape is one of the areas where artificial intelligence can be applied to many services, by automating complex processes and improving customer service and the value of the service. Let’s have a look at the main applications of artificial intelligence for payment processing, that can directly benefit Ecommerce.

Fraud prevention

Fraud prevention has become increasingly important for Ecommerce, especially considering the rise in fraud threats and cases in the past years worldwide and specifically in the UK. Among the fraud prevention solutions available on the market at the moment, artificial intelligence plays a big role in detecting and anticipating fraud.

One of the main use cases is to prevent false positives. Also called false declines, they refer to when legitimate transactions are denied because incorrectly categorised as suspicious by risk management filters. This creates problems not only when looking at the business revenue but it can also have a negative influence on customer experience and, as a consequence, hurt the brand reputation. Therefore, how can AI help reduce false positives? The process is called data enrichment and it involves integrating additional data points in given transactions to better track behaviours, after assigning a probability to them. The goal is to estimate whether to accept or decline the transaction based on the given data.

Chatbots

Another popular use case of AI in the payments landscape are chatbots, which can interpret the needs of the customer based on the information they are given and therefore suggest answers and solutions and even process payments for customers. Important tools to streamline customer service, AI chatbots can carry human-like conversations by using NLP, aka natural language processing, and via machine learning.

Although advanced, in order to achieve an optimal performance, these tools need to be used in conjunction with human interaction. They are extremely useful to answer to routine questions and solve common problems of customers, while saving human intervention for when needed. However, they are still at an early stage, especially in payment acceptance and management of the checkout and authentication processes.

Personalised Shopping

Big companies like Amazon and Netflix have already invested in personalisation of their services and offer extremely customised customer experiences on their websites/ apps, such as product recommendations based on previous purchases or on similar customer’s behaviours. These processes are run by artificial intelligence, which analyses existing data via machine learning, in order to develop a better understanding of the needs of the customer.

Authentications

Ecommerce merchants and financial institutions are already familiar with the 3D-secure authentication that is required in Europe since the PSD2 legislation for online purchases. One of the most significant additions in the new protocol was the use of biometrics for identifying the buyer. Biometric authentication is based on artificial intelligence and includes facial recognition, fingerprint scanner and voice detection. The way it works is that it takes into consideration the user’s biological traits in order to authenticate and validate a transaction. The biometric system market is expected to grow from USD 42.9 billion in 2022 to UDS 82.9 billion by 2027, at a CAGR of 14.1%.³

Payment orchestration

Finally, the last AI application in the payment landscape we want to focus on is payment orchestration. The global payment orchestration platform market is experiencing significant growth: according to a report by Grand View Research, it will grow at a CAGR of 24.7 per cent from 2023 to 2030.⁴

When we talk about payment orchestration – as we have seen in our article on the topic - we refer to platforms that integrate multiple payment gateways, service providers and different acquirers within a single point of access and are run by smart routing, which automatically switches to the best route for the transaction in order to get the best performance and cut on costs. Moreover, data from different providers and finances are integrated, making the process of reconciliation much easier and quicker. Smart routing is based on machine learning and by analysing existing transactions, the accuracy of the engine increases and the future payment processing performance is enhanced.

In conclusion, when we look at the fascinating world of artificial intelligence and the innovative changes it has brought to the payment ecosystem, it is impressive how much it has already been accomplished. From chatbots that understand customer needs and work as check-out points by accepting payments, to biometric authorisations that allow users to confirm their identity and accept payments by simply tapping with their finger on the smartphone screen or looking at the camera. However, we are only at the beginning and in the next years we will see rapid changes in technology that will lead to a further enhanced customer experience and quicker and more secure payments.

If you would like to learn more on the world of alternative payments, download our free whitepaper.

Sources

Market size and revenue comparison for artificial intelligence worldwide from 2018 to 2027 | Statista 2021

Chatbot market revenue worldwide from 2018 to 2027 | Statista 2022

Biometric System Market | Markets and Markets, 2022

Payment Orchestration Platform Market Size | Grand View Research, 2022

Our insights

Embedded Lending revolutionizes financing for businesses and consumers

Ransomware: a growing trend in the cyberfraud landscape